Many of us whinged and whined about the name change from IPTV World Forum to IP&TV World Forum because the names were too difficult to tell apart (if you are still looking, it was the adding of the ‘&’ in IP&TV). By naming the event TV Connect the organizers have now moved away far enough for the new name to stick. Now though it must be differentiated from the “Connected TV” events.

This year’s event is too big to just simply attend. I put on my thinking hat to ponder where things are going over the next three years, in order to decide who and what to see in Olympia. The trends below are new impressions of things I’m just beginning to understand, not the obvious ones like drowning in content.

For each trend I’ve suggested, in this blue font, which exhibitor I’ll be looking to see at the show. Please add a comment if you think I’ve missed something important, which of course I have.

Trend 1: Moore’s law looks like slowing down at last

My 2-year old gaming PC still plays all the latest games! Who’d have imagined, Apple still selling iPhone 4’s from its website three years after initial release?

At the same time, if the advantages of Broadband up to a “good DSL” speed (i.e. from ~10MBPS) seems obvious, many operators are struggling to sell “fibre” speeds (from ~100MPS and above) unless there’s no price increase.

Raw processing power is no longer enough in the TMT sector to reach the mass market beyond geeks & early-adopters, and soon raw bandwidth won’t be enough either. Services must serve a deeper purpose. Ok, how can that be done?

At TV Connect I'll be looking how the numerous device makers (just for the letter A there are already: Amino, Airties, ABox42, …) have improved the packaging and User eXperience of their products without necessarily changing all that much under the hood since last year.

Trend 2: Analytics everywhere

Big Data is a trendy topic currently at the height of its Hype cycle, which also represents a genuinely new approach. After over a decade of promises, the ability to ingest richer data and process it near to real time is finally here. At last, operators can focus on user experience rather than just connectivity.

I’ll try to scratch under the surface of the “Big Data” words I expect to see plaster onto many booths.

Trend 3: Colliding segments of QoE, UX and Security

The User eXperience (UX) domaine has only naturally linked with Quality of Experience/Service and monitoring. So I’ll be looking for how the QoS/QoE/Monitoring vendors are embracing overall User eXperience. I’ve written earlier about security companies as potential candidates for a stake in this new game, as they know exactly what is being watched by whom when it comes to premium content. In the age of abundance we have entered, a key challenge is content navigation that also means UI design, search and recommendation.

I suppose VO and Nagra come to mind first as having merged much of this, but I'll also be checking in no particular order: Witbe, Veveo, Verimatrix, Conax, Red Bee, Mariner, Jinni, Ineoquest, Genius Digital, Agama, …

Trend 4: CDNs going local and the Cloud coming to a TV near you

Other areas where there seems to still be some low-hanging fruit to improve User eXperience include the distribution of heavy (HD) content in networks. All operators with a fixed line network are racing to bring out their own CDNs.

Broadpeak seems to be the only CDN specialist

Some Cloud services like Dropbox or Network PVRs seem obvious. The jury is still out on others as the early disappointment of Connected TV has shown. OTT service delivery platforms (SDPs) will be another thing to look out for.

In the fog we’re all stumbling around in, I’ll try to see which of the one-stop-shops like Kit Digital, Siemens, Cisco, Ericsson or Nagra have the more powerful fog lights. Of course for a best-of-breed approach you’ll need to stop by at almost all the booths.

Trend 5: declining long-term value of Pay TV?

In the early 90s nothing worked better in the home than the fixed-line telephone. The availability and reliability of basic telephone services, whether mobile or fixed has significantly dropped twenty years later. Subscribers have been happy to trade lower prices and mobility for reliability and what we used to call quality. A similar trend can be seen with pay TV services. Early “cord-cutters” are showing that trade-offs are possible here too. Subscribers will probably trade old-fashioned TV quality for better variety, lower prices and better content navigation.

To keep the value in TV, some operators will use bundling or mashing-up TV types of service with social media and communication services.

The companies I’d talk to, to get a handle on this would be those at the forefront of social media like Accedo, or already close to operator’s triple play like SoftAtHome.

Trend 6: device wars growing fiercer

In what my friend Sebastian Becker calls a new rendition of “The Empire Strikes Back”, many European Cablecos have launched powerful boxes that have little to envy from a PC’s spec sheet, as for example with Numericable's LaBox. At the same time, Google is still happily ploughing millions into various device-centric Google TV projects, and Sony says the PS4 will revolutionize media in the living room. Nobody understands what Microsoft is saying: new OTT devices still crop up in shops ranging from powerful all-in-one boxes to tiny USB or HDMI sticks, … and the list goes on.

So short term, should I need to advise any operators on device architecture, I’ll go for being agnostic.

To get some clarity on this I’d drop in to the OIPF booth to see how standards are helping.

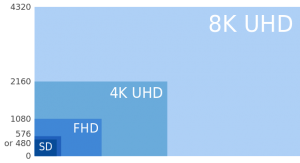

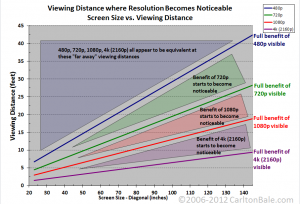

Trend 7: SD à HD à 4K

I saw Sony’s 4K screen at IBC and am a true geek on this one. The 4K industry drive will succeed because it just feels so right in the gut, where 3D with spectacles in the living room never could. 4K or ultra-HD will start to impact on us within three years.

I’ll be keen to see who at the show is already on the ball with 4K, although it’ll be harder to get the timing right on this than just be the fist too early mover.

Trend 8: Capex can really shrink at last

I have written over a dozen business cases for TV rollouts around the world and if you’re small, the killer Capex item is the head-end but if you’re large, it’s the STB.

For the former, new centralized digital “headend in the SKY” services substantial Capex savings. You just send files to be encoded streamed or whatever your head-end requirements are.

As for the larger operators, the STB can still be a killer cost as are fancy devices like the LGI Horizon box. People are actually happy though to spend hundreds of dollars on devices that are even more powerful than any STB. Once the empire has finished striking back, I sense a trend for overall lowering of STB costs.

I’ll drop by the usual suspects here for an update on head ends (Elemental, Envivio, Harmonic, Ateme, etc.) but also try to understand where Avail TVN is at.

Trend 9: Hello TV, Goodbye TV

If the 8 previous trends have a dose of gut feeling, this one - pure conjecture - feels right. I have come to realize that many of us work in the market sector we call TMT. Before I looked it up, I assumed that one of the T’s was for TV. Maybe I’m spending Too Much Time on this, but the acronym actually stands for Technology, Media and Telecoms, no TV anywhere.

So could TV have been just a passing thing? Before IPTV there wasn’t any TV on IP networks, and now in the age of multiscreen galore and OTT, is “TV” already being pushed back out of IP networks in favour of just “video”? Maybe one day there’ll just be Sports, News and Video left so beyond the three year time-frame of this blog we can all come back to the 2017 event which will be rebranded the SNV World Forum.